The Global and U.S zinc market has seen prices drop over the past few weeks particularly due to the volatile nature of the markets. This is especially due to the ongoing trade war between China and the U.S, as well as the geopolitical factors in the European region.

Regardless of the not so appealing nature of the market, zinc still remains a good investment and, for all the good reasons. It is currently one of the most useful metals in the world and this means that its demand in major industrial markets such as the U.S and other global markets will remain high. However, the opposite can be said for its supply.

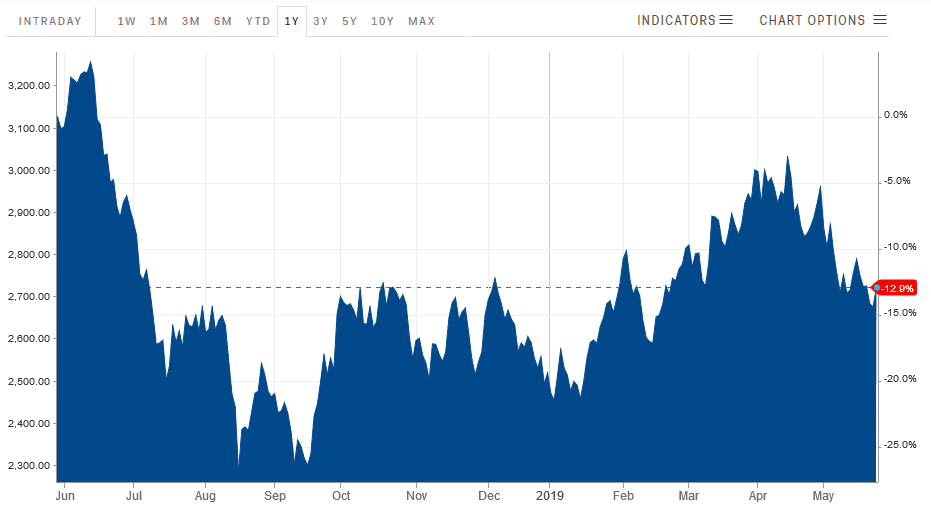

According to Shine Minerals Corp (CVE: SMR), zinc inventories are currently at their lowest point over the last ten years. Shine Minerals is also making significant strides in zinc mining and has shown a lot of promise. The main reason for investing in zinc is because prices are expected to improve. For example, the prices of the metal recently surged slightly in April due to concerns about shortages. However, the price of the metal lost some of its gains since early May due to the volatile trade conditions.

The U.S is one of the major Zinc consumers while China is the largest producer of zinc in the world. The current trade situation, therefore, affected the supply in a major way. There is currently a lot of friction for Chinese products making their way into the U.S market.

Meanwhile, the global zinc market is still experiencing a major supply deficit which has prevailed since 2016. This slow supply was mainly due to the closure of some major zinc mines, thus leading to less production of the metal.

Zinc market outlook

Market experts believe that the zinc market, especially the supply aspect will improve between 2019 and 2022. Shine Metals is among the companies expected to lead the supply especially following its recent breakthrough in Canadian mining expeditions at Watts Lake, Saskatchewan. The current growth forecast for the 2019-2022 period projects that the global supply of zinc will grow at a 3.8% compound annual rate to around 15.7Mt over the three year period.

Market analysts also expect the supply and demand gap to continue narrowing and even shift into a surplus state very soon. This optimistic outlook for the market is fueled by the new zinc mining projects that are scheduled to kick off soon. There are roughly 100 zinc mining projects that are expected to commence their operations in the next three to four years. These projects are expected to fill the supply gap for the metal, thus satisfying the massive demand for the metal in the market.

This growth outlook will also influence zinc prices which will most likely improve over the next three years thus making it a good metal invest in. It makes sense to invest now and reap the benefits later on once the prices of the metal reach more stable and more appealing levels in the future.