The metal mining industry has been experiencing a surge in the demand for zinc but at a time when the supply of the metal has not been all that good. However, demand means there are solid opportunities in the market and few industry players such as Zinc One Resources Inc (OTCMKTS: ZZZOF) will reap the benefits.

Zinc is one of the less popular metals but it happens to be one of the most useful metals out there. Some of its uses include the process of galvanizing steel, it is used in nuclear reactors, the making of solar cells and infrastructure development among other uses.

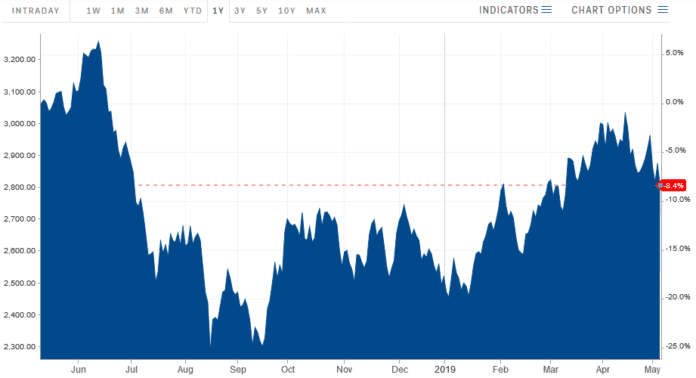

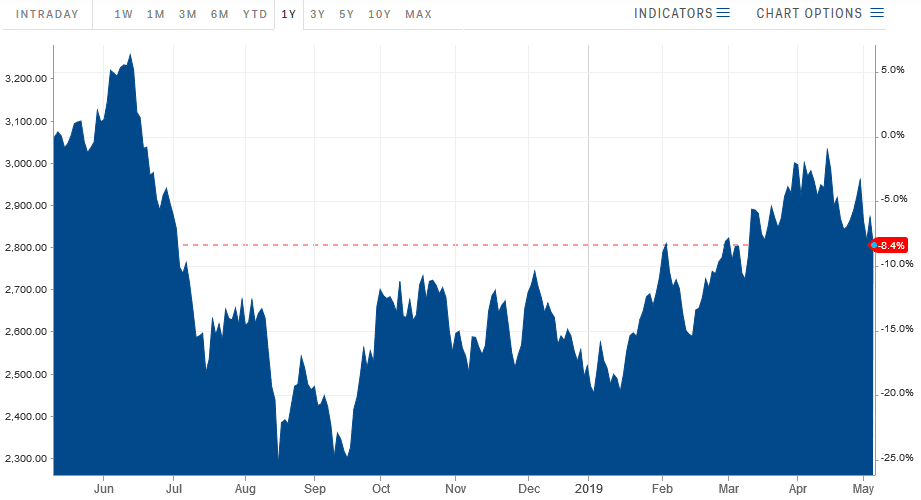

There has lately been an increase in the demand for zinc but unfortunately, the market has been characterized by low supply. The law of supply and demand has therefore kicked in causing zinc prices to start surging. The chart below demonstrates the prices of the metal for the past 12 months.

Source-chart demonstrating zinc prices for the past 12 months

The price of Zinc demonstrated bullish momentum since the start of 2019 after low prices in the second half of 2018. The dwindling supply of zinc and surging prices have encouraged suppliers to start seeking more deposits of the metal. Most of them are looking for deposits of the metal that are near the surface so that they can mine and supply cost effectively.

The focus is now on Zinc One, a Canadian firm which deals with the process of producing Zinc. The company’s business includes prospective mine acquisition as well as exploration and mine development. It likes to deal with zinc mines located in mining regions such as Peru where it acquired the Charlotte-Bongará mining operations.

The conditions are ripe for Zinc One to take advantage

Gunther Roehlig, Zinc One’s interim CEO noted that the company plans to kick off zinc production at the Charlotte-Bongará operations sometime soon. This means that the zinc supplier is in a good position to take advantage of the growing demand for zinc in the market. If all goes well then the company will be able to supply the metal at a time when prices are also favorable.

“One of our main advantages is we’re on the fast-track to permitting. We could have these projects permitted within 18 to 24 months,”stated Roehlig.

The Zinc One CEO revealed that the company has the capacity to mine 500 tonnes every day and an annual zinc production capacity of 30,000 tonnes. Other than the demand advantage and the mining advantage, Zinc One also has another extra added advantage which is local backing. Local communities and the Peruvian government support the company’s mining efforts in the country especially in the Bongará mine which will be reopening after about a decade.

There were zinc mining operations in the Bongará mine in 2007 and 2008 but then those operations were shut down due to the financial crisis which negatively affected zinc prices. The mine is a key asset for Zinc One because it has rich zinc deposits near the surface.