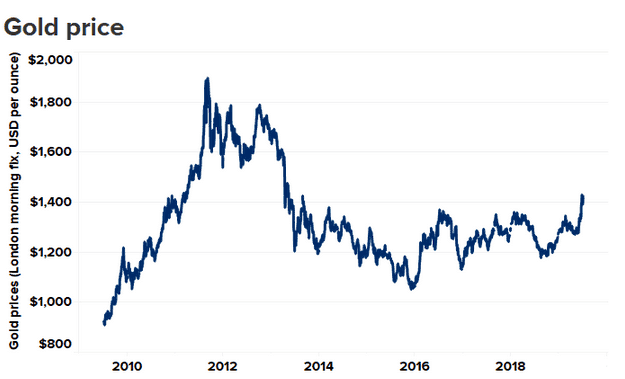

Gold is performing well in the market currently despite the wild fluctuations over the last two years. If the current growth rate holds strong, the yellow metal could recoup the $1,892.54 high it attained in 2011. In this light, there is a lot of activity in the Canada gold mining industry aimed at establishing a strong position in the market.

Global gold prices on a roll

Globally, gold is on a roll. To be sure, the price of the precious metal has been rising for the better part of 2019 and reached a multiyear high on June 25 where it clocked $1,422.85. This is the highest spot gold price since 2013. The same is true about gold futures which clinched the highest point in six years at $1,417.70.

In light of the rally, analysts are eluding at a possible all-time high of $2,000 by yearend. Particularly, market-wide expectations of a Fed rate cut and growing geopolitical tensions could add more impetus to the growth of gold prices.

Typically, such conditions discourage investment in risky assets like equities and forex, hence leading investors to pour money in the safe-haven assets where gold is one of them.

On Monday, July 8, 2019, the US reported nonfarm payrolls and they were stronger than expected. Obviously, this led to a small decline in the gold prices but the effect is likely to wear off in a matter of days.

In Canada, gold prices are higher but the market has failed to take note of it. Bloomberg data showed that in early morning trading sessions on Tuesday, gold spot prices clocked higher at $1,895.20 CAD than the previous day.

In 2011, the gold prices in Canadian currency peaked at $$1,881 CAD. This is to say that the price reached on Tuesday was an all-time high. Despite the news, many Canadian gold mining stocks have not shown signs of huge price growths.

Is it the right time for M&A activity?

Clearly, the market in Canada is indifferent to the uptick in gold prices. Nonetheless, the resurgence of the yellow metal has created the right environment for corporate expansions. To be sure, the gold mining industry is coming from a period of weaker gold prices and the need for companies to maintain a lean and effective operational strategy.

Now, as the prices soar, it is time for the companies to consolidate their reserves. Typically, miners grow their reserves either via sending exploratory teams out in the field or by taking over companies which have proven reserves. The exploration way is cumbersome, expensive and uncertain. Therefore, it is only logical that miners participate in M&A activity.

It is actually the right time for the M&A activity. Last year, Barrick Gold made public its intentions to merge with Randgold. The plan was consummated at the turn of 2019 creating a gold mining behemoth. The new company has the capacity to produce between 4 and 5 million ounces of gold per year. This is a huge capacity which can only be satisfied by a huge deposit of the below metal below ground.

Just three months later, Barrick’s American rival, Newmont went for and boughtGoldcorp in a deal valued at $10 billion. Before Barrick’s merger with Randgold, Newmont was the top dog in the gold mining sector. Therefore, the combining of assets with Goldcorp retained Newmont’s top dog position and with even more gold reserves.

Typically, when industry leaders combine their businesses to consolidate more reserves, pressure mounts on the juniors to fight for relevance. Notably, the M&A activity by Barrick and Newmont created huge companies which are difficult to compete with.

Now, the junior miners have to find likeminded partners to be able to stay afloat. Interestingly, this was already happening in the aftermath of the Newmont-Goldcorp merger.

To be sure, M&A activity skyrocketed in value in Canada’s British Columbia district in the first three months to April 2019. By May 29, there were 145 M&A deals in BC whose gross value totaled $20.45 billion.

In Toronto, Lundin Mining just closed the acquisition of some assets belonging to Yamana. Particularly, Lundin took a controlling stake in Brazil’s Mineração Maracá Indústria e Com

ércio which owns the Chapada mine. This mine has reserves for both gold and copper.

Advantages of the consolidations

- Bringing back investor confidence in the industry

The rise in the M&A activity in the gold mining industry is very significant in terms of improving the market sentiment. In Canada, the broader mining industry has been under pressure to perform for much of last year and the decade past. There have been reports of a cash crunch which, particularly, affected the junior mining sector.

In May this year, Mark Bristow, the CEO for Barrick, commented that the broader mining industry was in bad shape. Particularly, this was due to poor performance in the past decade. As per Bristow, it is a shame for the mining industry to survive on mergers and acquisitions.

Similarly, Sean Boyd, CEO for Agnico Eagle Mines Ltd, said in April that the mining sector is shrinking.

But looking at the recent gold spot price movements, one can only conclude that the industry leaders were harsh and pessimistic in their assessment. In fact, the skyrocketing in the number of M&A deals which are closed is indicative of a sector which is poised for exponential growth.

To put this in context, gold prices hit the all-time high in 2011. During this period, there were 1,440 deals in the junior mining sector. In total, companies raised $8.03 billion CAD from the deals. Similarly, this year is likely to mimic this growth if the gold prices continue to remain on a positive trajectory.

Therefore, it is clear that one of the huge advantages of the M&A activities is that they bring confidence back into the sector. Subsequently, this attracts the much needed credit and financing for companies to ramp up production.

- Increased gold output

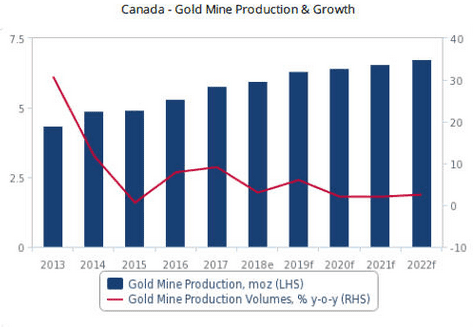

Another vital advantage of consolidations is that gold production will increase. Typically, miners combine their assets with the primary goal of increasing their reserves. With larger reserves, the companies can escalate their production volumes comfortably.

Last year, EY Canada had estimated that the gold output in Canada would grow by a measly 2%. In the background of a strong start to 2019, the consultancy revised the figure to 6%. This growth in production output is set to grow constantly through 2022, as per research by Fitch Solutions.

- Further expansion of Canada’s GDP

Mining is critical to the economy of Canada. In 2017, the mining sector contributed close to $7.2 billion to country’s GDP. Unsurprisingly, Gold ranked as the most valuable metal during that year with a value of $8.7 billion. During that year, the production of gold was just a few thousand kilograms short of 165,000 kgs.

Therefore, if the production of the yellow metal grows as predicted, the contribution of the mining sector to Canada’s GDP is set to expand. The growth of the M&A activity is one assurance that this is quite possible.

Disadvantages of the M&A activity

- Consolidation could go wrong

While the consolidation has an overwhelming upside, the downsides do exist. In the bid to grow their reserves, some companies are bound to make mistakes which could set off an avalanche of business collapse in the whole sector.

For instance, Newmont’s acquisition of Goldcorp raised eyebrows given the amount of baggage Goldcorp had. To be sure, Goldcorp is a woeful performer when it comes to the share price. In 2002, the company’s share price was

$9. During this period, gold was grossing for only $300 for a single ounce. 17 years later, gold is approaching $1,500 but Goldcorp (NYSE: GG) is just $11.19.

The company has badly underperformed the GDX benchmark, in fact by 50%. On the other hand, Newmont has outperformed the index by 50%. Therefore, it is easy to see that if Newmont does not get everything right, the acquisition could be devastating.

- Faster depletion of reserves

After the merger of Barrick and Randgold, production capacity of the new company suddenly rose to between 4 and 5 million ounces per year. This implies that the company has to ramp up its operations to match the expectations. While at that, the reserves will deplete at a very high rate.

Other companies like the new Newmont Goldcorp will also have to track rival productions to remain competitive. Overall, the increased production could, at best, lead to a supply glut and, at worst, deplete gold reserves.

Wrapping up

It goes without saying that the current soaring gold spot prices are spurred by souring investor sentiment in global trade. Events like the US-China trade war and the escalation of confrontations between Iran and the US are quite dangerous to global stability. As such, safe-haven assets are becoming attractive.

Nonetheless, the price rally in the gold mining sector is fueling the growth of M&A deals. If successful, the consolidation efforts have the potential to further the attractiveness of the industry in the near term and the longer term.