Bolt Metals Corp. (OTCQB:PCRCF)

A rare metal, vital to military applications…

A US government desperately trying to protect its energy and military security from foreign enemies…

The clean energy boom leading to skyrocketing demand for critical minerals…

The stage is set for potential massive gains in a small junior miner with the strategically vital mineral assets that America craves.

The world stands at a dangerous crossroads…

War rages in Ukraine, with threats of a nuclear escalation.

The Middle East is on the brink of a clash between Israel and Iran.

And in the Pacific, China’s increasing aggressiveness is testing the US’ resolve.

At the same time, the era-defining shift to clean energy and EVs is putting enormous strain on supply chains of the critical minerals that power the global economy.

Most investors think the clean energy revolution means a huge rise in demand for silver, cobalt, and the rare earth metals.

They are right – but that’s only the tip of the iceberg…

A currently under-the-radar metal is likely to become the most critical of all in the green revolution – and, very possibly, its star performer.

What’s more, this brittle and silver coloured substance plays a major part in the production of explosives, nuclear weapons, infrared sensors, and flame retardants – all vital parts of America’s defences.

And here comes the scary part…

And here comes the scary part…

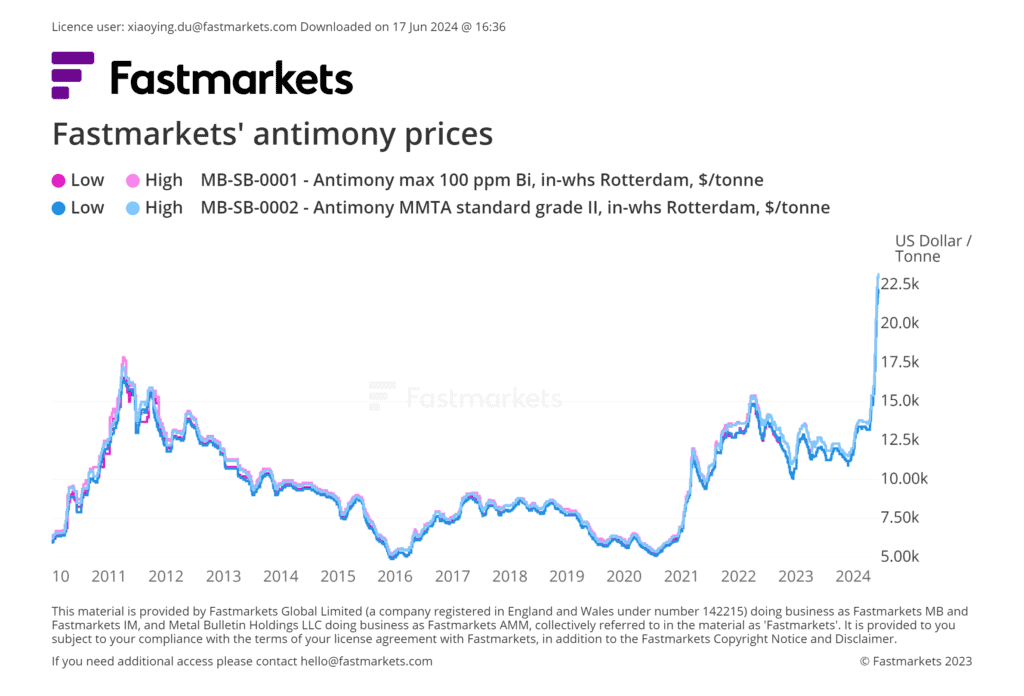

The production of this fundamental element is today almost fully in the hands of America’s enemies – China and Russia, which account for almost 80% of its global mine production.

What’s America’s production? ZERO.

Incredibly, the US hasn’t mined a single gram of this valuable metal since 2001, leaving it to play a desperate game of catch-up to guarantee its national military and energy security.

Especially considering that American manufacturers gorge on a staggering 50 million pounds of it every year.

The situation is changing quickly, but investors are yet to notice…

The US government recently realized the strategic necessity of having a domestic supply of this critical resource.

And with Donald Trump about to retake the White House, the call for an “America First” agenda for economic independence will be louder than ever.

A small cap junior has assembled a portfolio of strategic assets to satisfy America’s craving for resource securityAnd when investors soon realize that is happening, its stock could deliver life-changing returns..

Bolt Metals (OTCQB:PCRCF): An Untapped Antimony Pioneer Ready to Redefine The Age of Critical Minerals

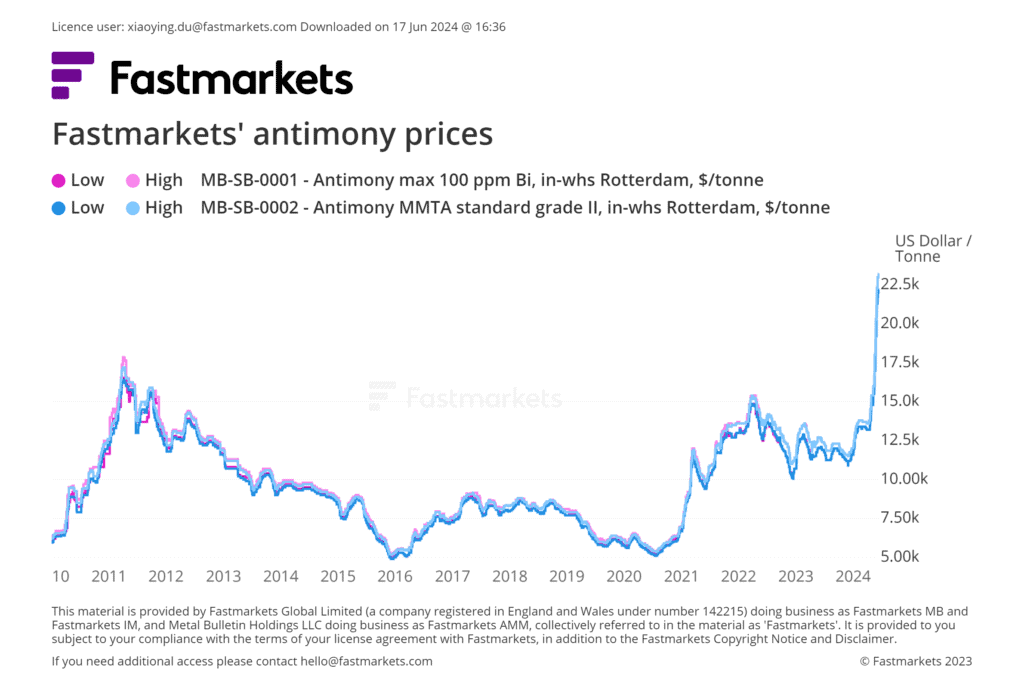

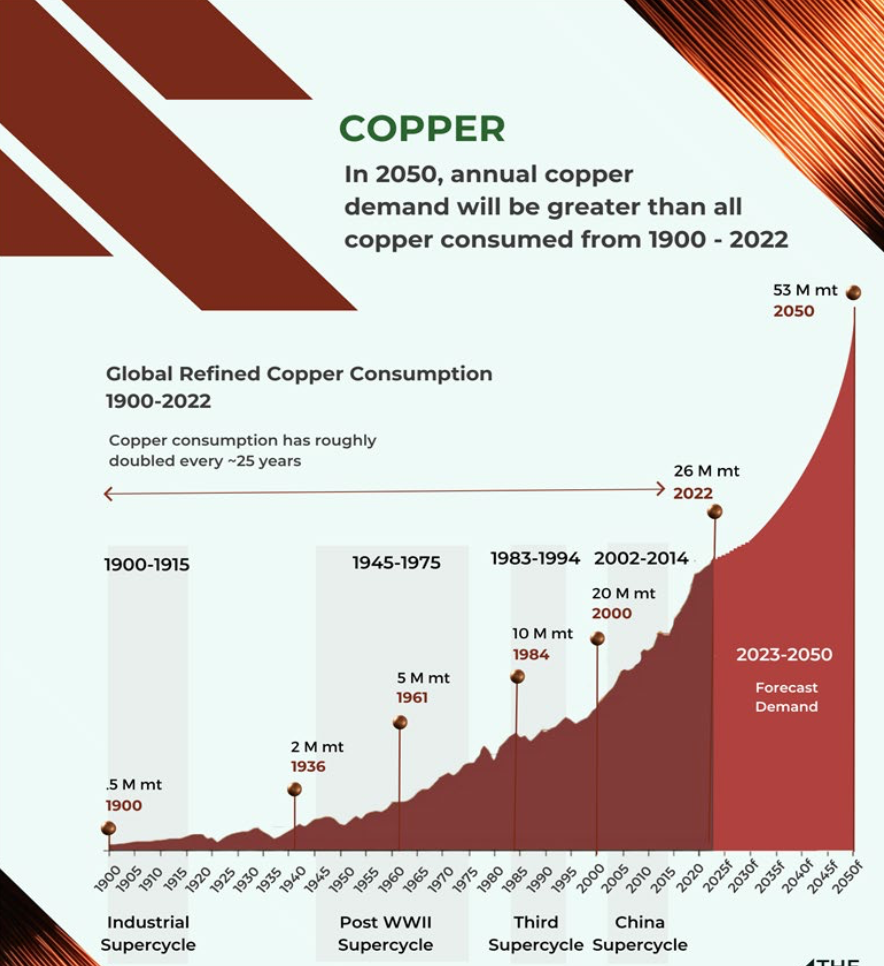

The critical metal we are talking about is Antimony (Atomic number 51, Symbol: SB), which is undergoing a dramatic surge in prices, rising a blistering 300% since 2020 and reaching all-time highs of over $22,500/tonne in 2024:

News reports paint a picture of a gloomy demand and supply imbalance, backed by hard data:

- Antimony demand from the photovoltaic sector, where the metal is used to improve the performance of solar cells, will increase to 68,000 tons in 2026 from 16,000 tons in 2021, with the supply gap expanding to 21,000 tons by 2026 from 8,000 tons last year.

- In August 2024 China, responsible for 48% of global production and 63% of US imports, announced export restrictions on antimony in the country’s latest move to restrict critical mineral shipments globally in the name of national security.

- The US’ strategic stockpiles of antimony amount to only 1,100 tons, less than one twentieth of the 23,000 tons consumed in 2023.

And analysts are already talking of prices surging to $30,000/ton in the next 12 months, as countries scramble to stockpile the metal in view of potential long-term shortages.

In this high-stakes game of resource geopolitics, we scoured hundreds of stocks to find the one most likely to benefit from the boom in Antimony prices.

What we have uncovered is the most obvious candidate in terms of geography, assets, and management team – Bolt Metals Corp. (CSE: BOLT, OTCQB: PCRCF, Frankfurt: A3D8AK).

BOLT: The Next Antimony Powerhouse – With Additional MONSTER Potential in Copper

BOLT is more than just a big bet on antimony: it’s a potentially explosive copper and silver play.

And when it comes to the green revolution, the roles of copper and silver are unparalleled – with applications covering EVs, wiring, energy production, renewable energy infrastructure, medical equipment, and more.

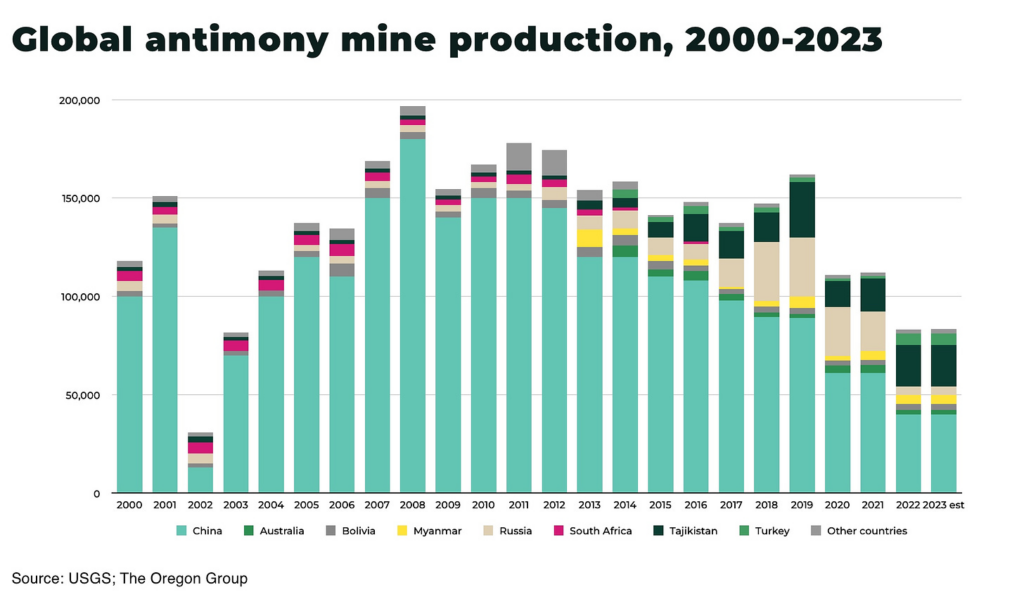

Copper’s bullish numbers speak for themselves:

- The International Energy Agency predicts copper demand will DOUBLE by 2035 due to the proliferation of EVs and renewable energy projects.

- Current mined production will struggle to rise by 20% in the next decade, with rapidly declining ore grades and reserves worldwide

- Analysts see shortages already in 2025 with prices rising up to 75%, as the AI revolution is proving an additional giant demand booster

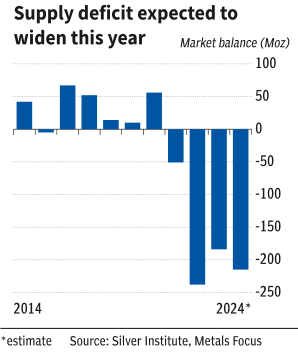

Silver’s future looks bright as well:

- Silver has been in a supply deficit every year since 2021 and the deficit will rise by 17% to a record 215.3 million troy ounces in 2024.

- An Oxford Economics study shows global demand skyrocketing by 42% between 2023 and 2033.

- Prices are up 44% in 2024 and could hit $50/ounce soon.

BOLT is perfectly positioned to take full advantage of these powerful trends with three highly attractive, early-stage properties in the US and Canada:

Soap Gulch Copper Project – A total of total 4340 acres in size, located across Montana’s Silver Bow and Madison Counties. The property had previous multiple drilling programs since it was held by major mining companies during 1970’s and 1980’s, with significant historic drill and trench results including up to; 4.7% Cu; 19% Zn; and 2.3 g/t Au; and 0.3% Co.

What’s interesting is that Soap Gulch is geologically comparable to Teck’s long-lived Sullivan Mine in British Columbia – a true MONSTER.

During its lifetime, the Sullivan mine produced a staggering:

- 8 million tons of lead

- 285 million ounces of silver

- 7 million tons of zinc

The commercial value of these metals was over $20 billion, and the mine was open for a mind-boggling 92 YEARS.

But there is more…

Soap Gulch is located just 32 kilometres south of another mining area known for massive copper, silver, and zinc resources, highly attractive mine economics, and excellent infrastructure.

This mining area is known as the Butte copper mine district, which has produced:

- 9.6 million tonnes copper

- 2.1 million tonnes zinc

- 381,000 tonnes lead

- 715 million ounces of silver

The potential is there, and there is more evidence for it…

Airborne geophysics completed in 2018 imply a number of significant untested geophysical anomalies and the company has identified a potential 20km zone trend of mineralization.

5,000m+ of preserved historic drill core never assayed for copper (worth $3.4M CAD), gives BOLT the equivalent of a highly-cost effective drill program – which the company can use to define the resources of what could be the district’s next mine success story….

New Britain Antimony and Gold Project – A massive 2,466 hectare property located strategically 40 km north, north-west of Kaslo, BC and accessible by highway and forest service roads. Historical data from the New Britain property has revealed world—class assays – including a stunning 2,358 g/t silver, 29.9% lead, and 10.4% antimony. Geological mapping indicates a southeast-northwest trend in geology and structure, interpreted to trend onto the New Britain property.

Switchback Copper-Silver Project – In October 2024, BOLT executed a transformative acquisition: the Switchback Copper-Silver Property, located 55 kilometres east of Terrace, British Columbia. This 2,560-hectare property boasts eight contiguous mineral claims and is highly prospective for volcanic redbed copper and polymetallic deposits.

Preliminary exploration results highlight a massive potential, with grab samples returning impressive grades, including:

- 1,975 g/t silver

- 11.86% copper.

Geochemical and geophysical surveys outlined a coincident broad anomalous area, measuring a significant 3.5 x 1.0 km in size, with intensity increasing to the southeast.

The maiden drill program in 2022 intersected significant mineralization including 20.8 g/t silver, 1.5% lead, and 3.6% zinc.

Much of the coincident geochemical and geophysical anomalies at Switchback remain to be drill tested – giving BOLT significant potential for resource definition and expansion.

Recent news highlights how Switchback could be a game-changer.

An NI 43-101 Technical Report was completed in October 2024, paving the way for a Phase-1 exploration program slated for 2025.

This will include trenching and advanced mapping to delineate the full extent of mineralization – unlocking the potential for a major resource and positioning it for accelerated development.

BOLT’s properties are located in Montana and British Columbia, both among the Top 20 best mining jurisdictions in the world.

And BOLT’s management is implementing an aggressive plan to turn the company into America’s next critical mineral powerhouse…

The BOLT Team: Mining Mavens with a History of Growing Mineral Resources

The BOLT Team has the ambition, know-how, and experience to move BOLT forward in defining a major mineral resource – the rocket fuel for BOLT stock.

Branden Haynes – CEO & Director

A mining veteran with 25+ years of experience, Branden was previously CEO of Aeonian Resources Ltd and of Hawkmoon Resources Corp (CSE:HM). As CEO of Hawkmoon spearheaded the deployment of two exploration programs (8,500 meters) and guided the company to a successful IPO.

Garry Clark – Professional Geologist & Director

A recognised geologist with 30+ years of field experience, managing successfully large scale exploration and development programs internationally. He is the Executive Director of the Ontario Prospectors Association (OPA) and currently serves on the Minister of Mines Mining Act Advisory Committee. Garry played a major role in the successful sale of US Cobalt to First Cobalt Corporation, creating a post-transaction cobalt company valued at almost $400 million.

Ben Whiting – Technical Advisor

A professional geoscientist with 40+ years of experience working for major & junior companies and special advisor on mining industry matters to governments and the World Bank. Ben won the 2008 IAC “Explorer of the Year” for his role in the discovery of the massive La Preciosa Silver-Gold Deposit in Mexico, with its 110 Moz+ in silver resources.

Now join the dots.

Because this team of world-class mining executives has set BOLT on a course of major resource expansion, this will soon be reflected in its stock price…

The Next Catalysts Are About To Ignite BOLT’s Stock Price…

The investment potential of BOLT is clear as it is explosive. A number of major catalysts are about to put BOLT fully onto investors’ radars:

Unrivalled Strategic Assets – Located in two of the best mining jurisdictions of the world, sporting excellent grades, blessed with superior geological features, with excellent infrastructure links.

Soap Gulch Resource Definition – In the next 3-12 months, BOLT will send historic core samples for detailed assay analysis, develop updated geological model and drill targets, and complete a diamond drill program. All these activities will lead to developing a NI 43-101 compliant resource – catapulting BOLT’s market value closer to those of development stage miners.

Switchback Exploration Progress – With the NI 43-101 Technical Report in hand, Bolt Metals is gearing up for an intensive exploration campaign to unlock the full potential of this high-grade copper-silver property.

Uplisting to Major Markets – Bolt Metals is pursuing an application to uplist to the OTCQX® Best Market, the premier tier of OTC markets in the U.S. This move will enhance liquidity, broaden the investor base, and increase visibility. And the math is very simple: more liquidity equals more investment equals a higher stock price.

Perfect Timing – The timing for BOLT is ideal. The United States has already signaled its commitment to the goal of securing its supplies of materials needed for its defence sector. President Biden’s invocation of the Defense Production Act to boost domestic critical mineral production highlights the urgency of this mission. And Donald Trump is only looking to accelerate the drive for self-sufficiency in critical metals – a further long-term boost for BOLT.

New Britain Drilling Program: Expanding the resource base at the New Britain property will involve wide reconnaissance, mapping, sampling to determine pervasiveness and grade of antimony mineralization.

Strategic Partnerships: Discussions with major players in the mining and battery industries are already underway, signaling potential joint ventures and future offtake agreements.

A Strong Financial Position: BOLT is well-capitalized to execute its vision. In 2024, the company successfully closed a non-brokered private placement, raising over C$1,348,250 in gross proceeds. This injection of capital will fund exploration activities, strengthen working capital, and support corporate operations.

The catalysts are strong and clear.

But as we write, there is a window of opportunity in this market for BOLT investors to get in at a bargain price.

And it looks like this window may be closing very soon…

Why you need to get into BOLT – and why NOW.

The truth is, we could easily be at the start of a major, multi-year, era-defining bull market in critical mineral resources.

And when these bull markets happen, the biggest price performers are always the same – small cap juniors with great mineral resources, effective teams, and rising investor recognition.

Right now, BOLT is trading at a market cap of only $7.5M CAD:

Investors are starting to take notice of the potential, with the price already up 30% in 2024.

But +30% is NOTHING compared to what could be lying ahead…

Because when mining juniors move up big, they don’t stop after a few weeks: they keep on rising over months and even years.

And double digit gains often turn into massive 10x, 25, or even 30x price gains.

Investor sentiment can change on a whim, and when even a fraction of the trillions of dollars invested in markets find their way to the Antimony niche, BOLT stock can only go one way – up.

This is a ground-floor valuation for mineral assets which are strategic, high-quality, and rising in price – literally by the hour.

Its valuation, assets, and catalysts make BOLT into a textbook case of a stock aching to explode higher.

Investors need to take action if they want exposure to one of the potentially most explosive junior mining opportunities of the 2020s. Don’t let another winner slip through your fingers – the time to buy BOLT is now.

Disclaimers GENERAL NOTICE AND DISCLAIMER – PLEASE READ THE FOLLOWING NOTICE AND DISCLAIMER CAREFULLY. YOU MUST AGREE TO THE TERMS CONTAINED THEREIN BEFORE USING THIS WEBSITE OR SUBSCRIBING TO OUR NEWSLETTER. Forward Looking Statements The contents of this article contain forward-looking statements and expectations that involve risks and uncertainties. These forward-looking statements include, but are not limited to, statements concerning any potential future plans of Nova Pacific Metals Corp. (The “Company”), including its strategies, operations, prospects, financial position, anticipated revenues, projected costs, profitability, management objectives, capital adequacy and expectations regarding demand and acceptance for the Company’s, growth opportunities and trends in the market in which the Company operates. The words “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would,” “potential” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. This article contains certain forward-looking statements within the meaning of applicable securities laws. All statements that are not historical facts, including without limitation, statements regarding future estimates, plans, programs, forecasts, projections, objectives, assumptions, expectations or beliefs of future performance, are forward-looking statements. The Company may not actually achieve the plans, intentions or expectations disclosed in the forward-looking statements and you should not place undue reliance on the forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements. These forward-looking statements involve risks and uncertainties that could cause the Company’s actual results to differ materially from those in the forward-looking statements, including, without limitation, the risks set forth in this article. General Information The content on Money News National (“MNN”) website is for informational purposes only and does not constitute professional advice. Any financial decisions should be discussed with a financial professional. MNN, owned by global service media (“GSM”), does not offer any specific financial, investment or mining advice. Users are strongly encouraged to consult with appropriate professionals before taking any actions based on the information provided on the MNN website. External Links Disclaimer The MNN website may contain links to external websites that are not provided or maintained by, or in any way affiliated with, MNN. MNN does not guarantee the accuracy, relevance, timeliness or completeness of any information on these external websites. MNN does not endorse or verify the accuracy of information on linked external websites and disclaims responsibility for any transactions or interactions between users and third-party providers. Professional Disclaimer MNN does not provide financial, investment or mining advice. The information provided on the MNN website should not be considered as a recommendation to buy, sell or hold any security or financial instrument. Users should consult with appropriate professionals before making any financial decisions based on the information provided on the MNN website. Affiliate Disclaimer The MNN website may contain affiliate links, and MNN may receive commissions for purchases made through these links. These commissions help support the website and allow MNN to continue providing valuable content. Testimonials Disclaimer Any testimonials on the MNN website reflect the personal experiences of individual users and may not be representative of all users. Testimonials are not intended to represent or guarantee that any person will achieve the same or similar results. Errors and Omissions Disclaimer While reasonable efforts have been made to ensure the accuracy of the information provided on the MNN website, MNN cannot guarantee the completeness or timeliness of this information. The content is provided “as is” without any warranties, express or implied, including but not limited to warranties of performance, merchantability and fitness for a particular purpose. Sponsorship Disclosure This article is a paid advertisement and is not a recommendation to buy or sell securities. GSM, the owner of MNN, is being paid $40,000 per month in Canadian dollars (C$40,000), plus applicable taxes, by the Company for an ongoing marketing campaign, including this article. This compensation conflicts with MNN’s ability to be unbiased. This article is for entertainment purposes only. Never invest purely based on MNN’s communications. The owner of MNN and GSM may be buying and selling shares of the Company for its own profit. You are encouraged to conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

Disclaimers GENERAL NOTICE AND DISCLAIMER – PLEASE READ THE FOLLOWING NOTICE AND DISCLAIMER CAREFULLY. YOU MUST AGREE TO THE TERMS CONTAINED THEREIN BEFORE USING THIS WEBSITE OR SUBSCRIBING TO OUR NEWSLETTER. Forward Looking Statements The contents of this article contain forward-looking statements and expectations that involve risks and uncertainties. These forward-looking statements include, but are not limited to, statements concerning any potential future plans of Nova Pacific Metals Corp. (The “Company”), including its strategies, operations, prospects, financial position, anticipated revenues, projected costs, profitability, management objectives, capital adequacy and expectations regarding demand and acceptance for the Company’s, growth opportunities and trends in the market in which the Company operates. The words “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would,” “potential” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. This article contains certain forward-looking statements within the meaning of applicable securities laws. All statements that are not historical facts, including without limitation, statements regarding future estimates, plans, programs, forecasts, projections, objectives, assumptions, expectations or beliefs of future performance, are forward-looking statements. The Company may not actually achieve the plans, intentions or expectations disclosed in the forward-looking statements and you should not place undue reliance on the forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements. These forward-looking statements involve risks and uncertainties that could cause the Company’s actual results to differ materially from those in the forward-looking statements, including, without limitation, the risks set forth in this article. General Information The content on Money News National (“MNN”) website is for informational purposes only and does not constitute professional advice. Any financial decisions should be discussed with a financial professional. MNN, owned by global service media (“GSM”), does not offer any specific financial, investment or mining advice. Users are strongly encouraged to consult with appropriate professionals before taking any actions based on the information provided on the MNN website. External Links Disclaimer The MNN website may contain links to external websites that are not provided or maintained by, or in any way affiliated with, MNN. MNN does not guarantee the accuracy, relevance, timeliness or completeness of any information on these external websites. MNN does not endorse or verify the accuracy of information on linked external websites and disclaims responsibility for any transactions or interactions between users and third-party providers. Professional Disclaimer MNN does not provide financial, investment or mining advice. The information provided on the MNN website should not be considered as a recommendation to buy, sell or hold any security or financial instrument. Users should consult with appropriate professionals before making any financial decisions based on the information provided on the MNN website. Affiliate Disclaimer The MNN website may contain affiliate links, and MNN may receive commissions for purchases made through these links. These commissions help support the website and allow MNN to continue providing valuable content. Testimonials Disclaimer Any testimonials on the MNN website reflect the personal experiences of individual users and may not be representative of all users. Testimonials are not intended to represent or guarantee that any person will achieve the same or similar results. Errors and Omissions Disclaimer While reasonable efforts have been made to ensure the accuracy of the information provided on the MNN website, MNN cannot guarantee the completeness or timeliness of this information. The content is provided "as is" without any warranties, express or implied, including but not limited to warranties of performance, merchantability and fitness for a particular purpose. Sponsorship Disclosure This article is a paid advertisement and is not a recommendation to buy or sell securities. GSM, the owner of MNN, is being paid $40,000 per month in Canadian dollars (C$40,000), plus applicable taxes, by the Company for an ongoing marketing campaign, including this article. This compensation conflicts with MNN’s ability to be unbiased. This article is for entertainment purposes only. Never invest purely based on MNN’s communications. The owner of MNN and GSM may be buying and selling shares of the Company for its own profit. You are encouraged to conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.