The cannabis act

This month last year, the cannabis industry in Canada was sitting on the cusp of a major revolution. The cannabis act had just passed and companies were scrambling for an opportunity to exploit the legal cannabis market. Just over one year on, a lot has happened from which many lessons can be extracted.

Canada legalized use of marijuana for medicinal purposes in 2001. Until October 2018, all of the adult use market was supplied by the black market. As such, the enactment of the cannabis act intended to mainstream adult use of marijuana for two reasons. First, the government needed to protect the country’s youth from accessing the drug from rampant cannabis black market. Second, mainstreaming the adult use sector of the cannabis industry held a promise for huge amounts of tax revenue for the government.

So far, the revenue part is paying off. As at June 2019, the legal cannabis sector had earned the country $140 million USD ($186 million CAD) worth of tax revenues. In particular, most of the revenue was generated as excise duty on goods and services. Notably, Ottawa alone contributed approximately $55 million CAD. Interestingly, economists like Robyn Gibbard of Conference Board of Canada argue that the revenue income is commendable considering that the rollout of the cannabis act was bumpy.

Pot shortages

Under ten months since legalization, the cannabis industry in Canada faced its toughest test yet. While demand soared, supply of the substance seemed unable to keep pace. Interestingly, retailers had to turn some customers away just the second day after adult use pot became legal. The shortage of the drug grew persistent well into 2019 such that the probability of the problem dragging on for years became stronger. Speaking to the CBC in January, Chuck Rifici, CEO of Auxly, a pot company based in Toronto, said the shortage would worsen for at least 18 months.

Less than two months since legalization, it became clear that distributors lacked sufficient supply depth to satisfy the market. The supply dearth saw regions like Alberta freeze licensing of more cannabis retailers. According to the Alberta Liquor, Gaming and Cannabis Commission (AGLC), the national supply shortage occasioned the licensing pause. “Everybody’s in the same challenging boat where there’s not enough product to get through to the next order,” said Marcie Kiziak, a managing director of a prominent Alberta-based cannabis company.

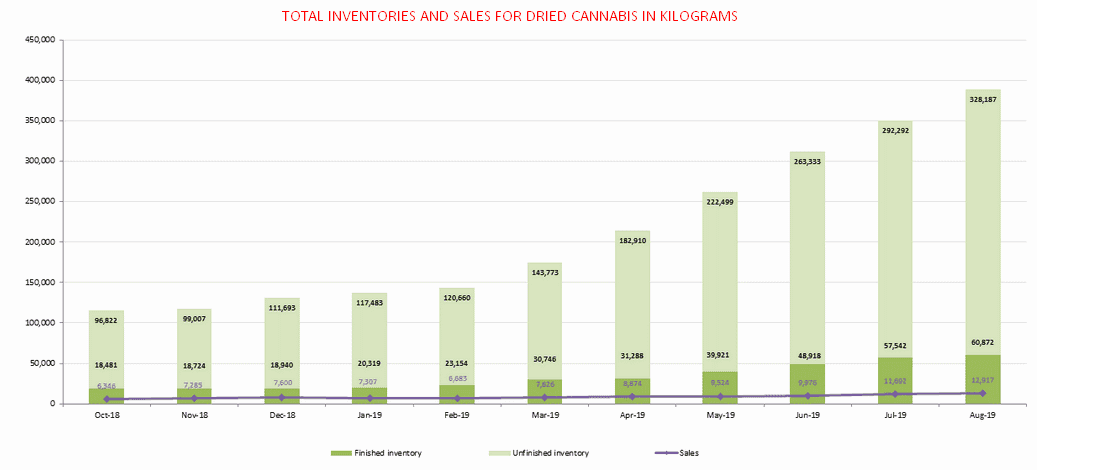

But where was the pot? According to government statistics, most of the dried cannabis inventories were unfinished. In October 2018 alone, the total unfinished inventory was 96,822 kilograms against 18,481 kilograms of finished inventory. From this huge disparity, one could easily deduce far serious problems than just the inability for producers to finish processing their inventory. Apparently, licensed producers faced packaging and processing bottlenecks. As such, they were unable to deliver to the product to the market in good time.

Another explanation for the pot shortage was the shortage of distributors. Each province has just one or two provincial distributors. As such, it was possible for one province to experience a surplus while others suffer a shortage.

The race to the bottom is looming

One year later, the tables seem to be turning. Seemingly, demand for pot did not follow the rising supply. According to Statistics Canada’s market data, the gap between supply and demand of cannabis has been opening up month over month. In October 2018, the total stockpile of dried cannabis was 115,303 kilograms. Comparably, producers sold only 6,346 kgs of dried cannabis in the same month. Ten months later in August 2019, producers were sitting on a dried cannabis stockpile worth 389,059 kgs. Interestingly, producers sold just 12,917 kgs of dried cannabis.

Source: Statistics Canada

In October 2018, the gap between supply and demand was 108,957 kgs. Fast forward, the gap has widened to 376,142 kgs. Nonetheless, it should not escape anybody’s mind that the amount of dried cannabis sold since legalization has consistently risen, except for the month of February 2019.

The bad news for licensed producers is that the large amount of inventory is likely to culminate in price wars. According to Matt Bottomley of Canaccord Genuity Corp., as quoted by the Financial Post, the mountain of inventory is likely to lead to “a race to the bottom with price because everyone now has more than enough supply.”

This is a huge irony considering the shortages the plagued the industry in its infancy. Experts like Bottomley do not hesitate to diagnose a “limited retail network” and an “exponential increase in the amount of cultivation space in use across the country” as the reasons behind the turned tables.

Cannabis 2.0 to the rescue?

Despite the vicissitudes so far, there is still a glimmer of hope. In the Cannabis Act enacted in October 2018, the regulations were narrow and focused only on select products. As such, need arose for amendments to widen the regulatory scope of the legislation. This October, the law was expanded to include derivatives like cannabis-based edibles and concentrates to be sold in the market. Cannabis 2.0, therefore, is simply the second phase of decriminalization of weed.

The significant achievement of Cannabis 2.0 is the broadening of the product range for cannabis companies. Notably, the increased product range could push the cannabis industry of Canada to $3.7 billion USD by 2020, according to Bethany Gomez from Brightfield Group. Comparably, the industry is projected to clock $1.6 billion by the end of 2019. If dried cannabis was underperforming, then Cannabis 2.0 should change the tide.

Speaking to CNN, Gomez added that Cannabis 2.0 should iron out some of the kinks that have made it impossible for Canada’s pot industry to maximize its potential. On the Cannabis Act, Gomez said “the rollout is always a lot slower than people are expecting it to be…” Notably, the main argument here is that, while Canadians might see the effect of pot legalization overnight, the industry will ultimately fall into place and profitability will finally arrive.

What does the future of the industry look like?

Canada is the first developed nation to legalize marijuana. As such, the country is largely pioneering most of the regulations for one of history’s most controversial industries. As earlier noted, the primary object of the Cannabis Act was to formalize the industry. It would be easier to control the supply chain of a legal industry and to keep youths away from pot use. Nevertheless, Canada has an uphill task ahead in terms of keeping the marijuana black market in check.

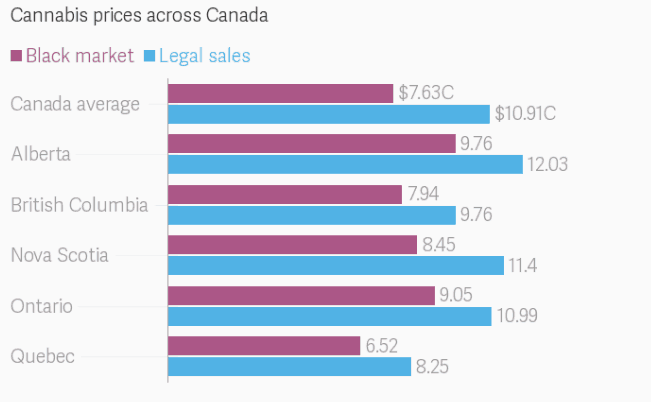

By April 2019, the legal market had shaved off only 30% of the cannabis industry, leaving the rest to illicit dealers. Notably, the reason for the resilience of the cannabis black market is the price disparity with the legal stores. A Statistics Canada survey showed that Canadians buy pot cheaply from the black market compared to legal stores.

Source: Quartz

However, the increased supply of the substance points to lower prices in the near future. On this basis, legal pot should increase its percentage of the market share. Further, Cannabis 2.0 should increase the number of consumers who buy from legal retailers. According to a Deloitte research, many Canadians are likely to buy edibles and other cannabis extracts because they “offer a more discreet and accessible way to consume cannabis and avoid any stigma surrounding smoking cannabis.” Ultimately, the future consumption of cannabis will experience a substantial shift.

Leading companies in Canada’s cannabis industry

Aurora Cannabis (NYSE: ACB, TSX: ACB)

Following the second round of cannabis legalization, Aurora made public the intention to exploit the cannabis derivatives market. Particularly, Aurora committed to roll out cannabis extracts once their legal status is active. In preparation for the launch, the company is readying production facilities in major cities in three Canadian provinces. In total, the facilities offer Aurora with over 450,000 sq. ft. of production space.

The product categories that the company will offer include vapes that come with 510 thread cartridges. In addition, the company will extract high quality concentrates that come without dilutive agents. Notably, the new facilities will facilitate an in-house production of the concentrates. Lastly, the company will offer edibles, which include chocolates, gummies, and bakes goods among others.

Chemistree Technology Inc. (CNSX: CHM)

The last few months have seen companies previously considered underdogs make huge strides towards market dominance, Chemistree being among them. In May 2019, way before the possibility of Cannabis 2.0 became certain, Chemistree set out to expand its Sugarleaf brand to include cannabis derivatives. Notably, this expansion was to be accompanied by the company pushing deeper into the US with operations in California and the Washington State.

Canopy Growth Corporation (NYSE: CGC)

Canopy Growth is the largest cannabis company in Canada by market capitalization. Interestingly, the company is also pursuing the cannabis derivatives segment seriously. During the Conference Call for Q1 FY2020 financial results, Canopy management revealed that the company had secured 56 patent applications related to cannabis derivatives. Some of the derivatives on target include vape oil.

Clearly, companies across the Canadian cannabis industry are gearing up for the anticipated demand growth following Cannabis 2.0 legalization. In addition, this is the clearest signal yet that the industry might have faced huge challenges but it has great potential. Interestingly, previously unattractive cannabis stocks might begin to grow in value.